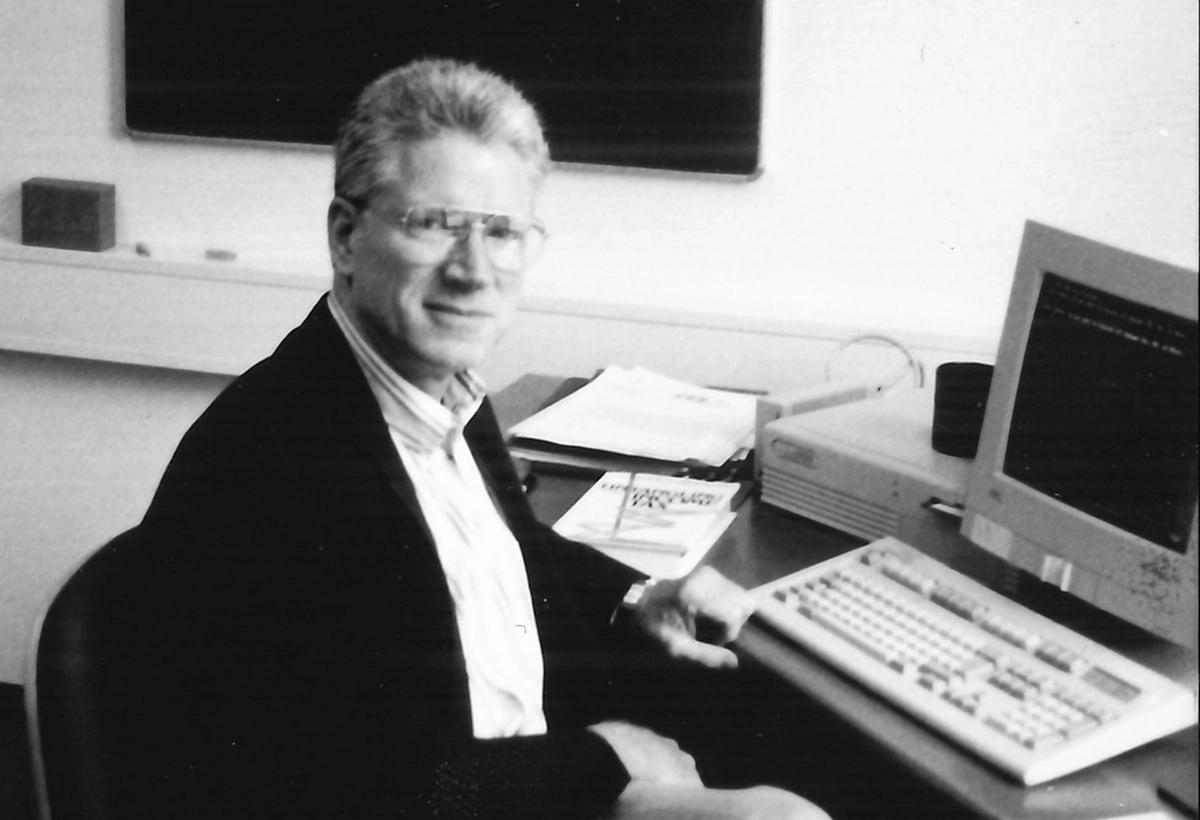

“David Bradford worked tirelessly and enthusiastically for the ifo Institute. His impartial judgment, wisdom and friendship were a great help.” This is what the ifo Institute wrote in its obituary about the American economist and political advisor David Bradford, who was one of the most important chairmen of the ifo Institute’s Scientific Advisory Council. Bradford died in 2005 at the age of 66. In his honor, the ifo Institute’s main building in Munich was renamed the “David Bradford House” that same year.

An Illustrious Academic and Political Career

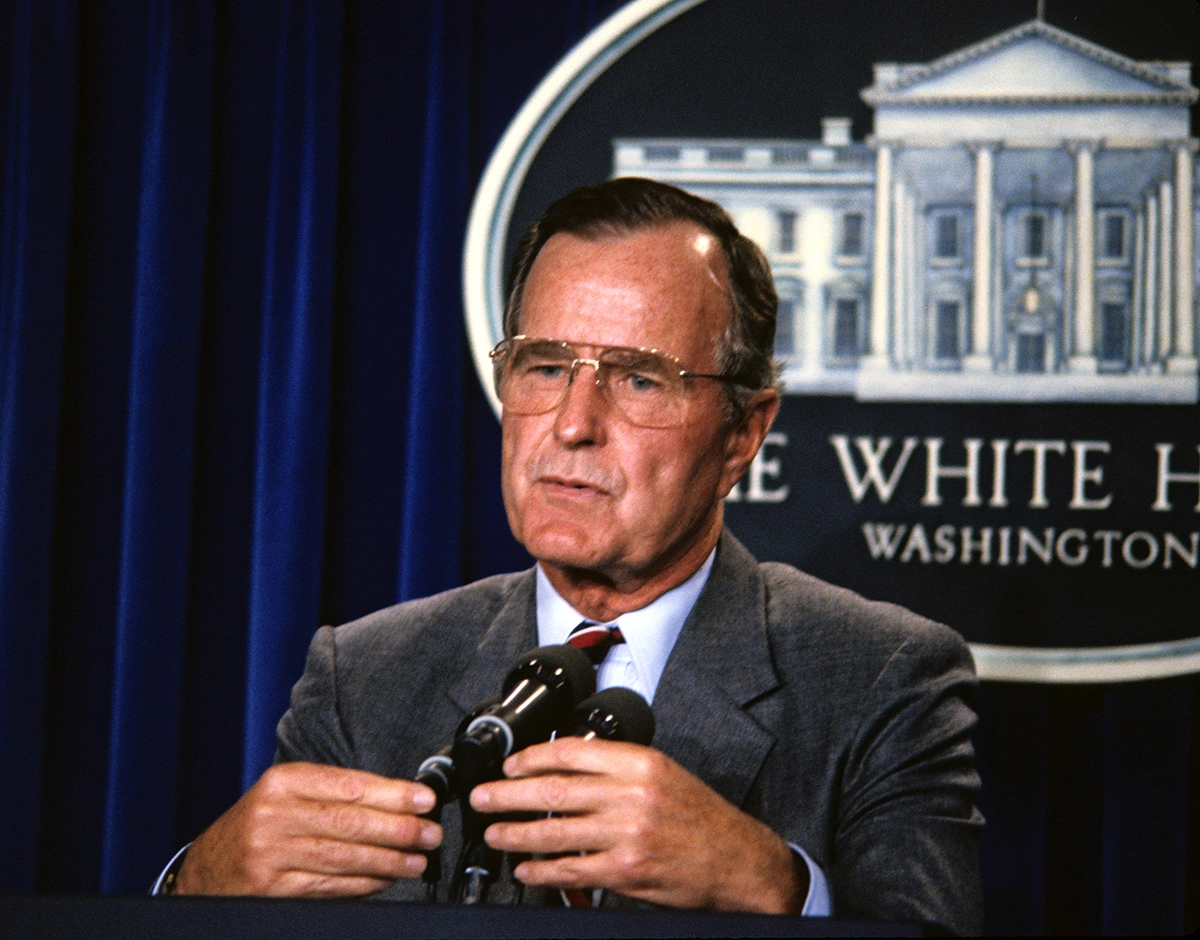

David Bradford’s educational journey took him from Amherst College in Massachusetts, where he studied from 1956 to 1960, to advanced degrees at MIT, Harvard University, and ultimately a doctorate from Stanford in 1966. He served as a Professor of Economics and Public Affairs at Princeton, and from 1993 at the Law School of New York University. Known as a leading expert in US tax policy, Bradford also held significant roles in government. He was the Deputy Assistant Secretary for Tax Policy from 1975 to 1976 and played a pivotal role in President Ronald Reagan’s tax reforms during the 1980s. From 1991 to 1993, he served as a personal advisor to President George H. W. Bush.

Bradford’s academic contributions significantly shaped public debate on consumer taxation, public goods pricing, urban planning, and environmental policy. A staunch advocate of the 2005 Kyoto Protocol, he was deeply involved in global efforts to combat climate change.

A Quantum Leap in Tax Policy

David Bradford’s seminal work “Blueprints for Basic Tax Reform” laid the groundwork for the sweeping 1986 tax reforms under Reagan, which dramatically reduced the top tax rate from 70 percent to 28 percent, positioning it as the lowest among industrialized nations at that time. His book “Untangling the Income Tax,” published in the same year as the reforms, offered an exhaustive analysis of income tax variations and championed the idea of a consumption tax.

The “X-Tax” Concept

Bradford’s X-Tax proposal sought to simplify and make the tax system fairer through a dual approach: taxing companies after allowing deductions for investments and payroll, thereby incentivizing job creation and innovation; and imposing a progressive income tax on individuals after subtracting private savings and investments, thus facilitating long-term financial planning for families. His vision was to exempt profits from financial transactions from taxes, creating a more streamlined and equitable fiscal environment.

Guiding the ifo Institute’s New Direction

When Hans-Werner Sinn assumed leadership of the ifo Institute in 1999, he faced a period of uncertainty about its future. Under his leadership, the institute’s Scientific Advisory Council was reconstituted, bringing on board twelve new members including Nobel laureate Robert Solow from MIT and David Bradford from Princeton University. After their appointment in May 2000, Bradford was elected Chairman of the Council in September of the same year. Under Bradford’s chairmanship, the Advisory Council played a crucial role in redefining the ifo Institute’s scientific direction, significantly contributing to its ascent as a premier global economic research institution.