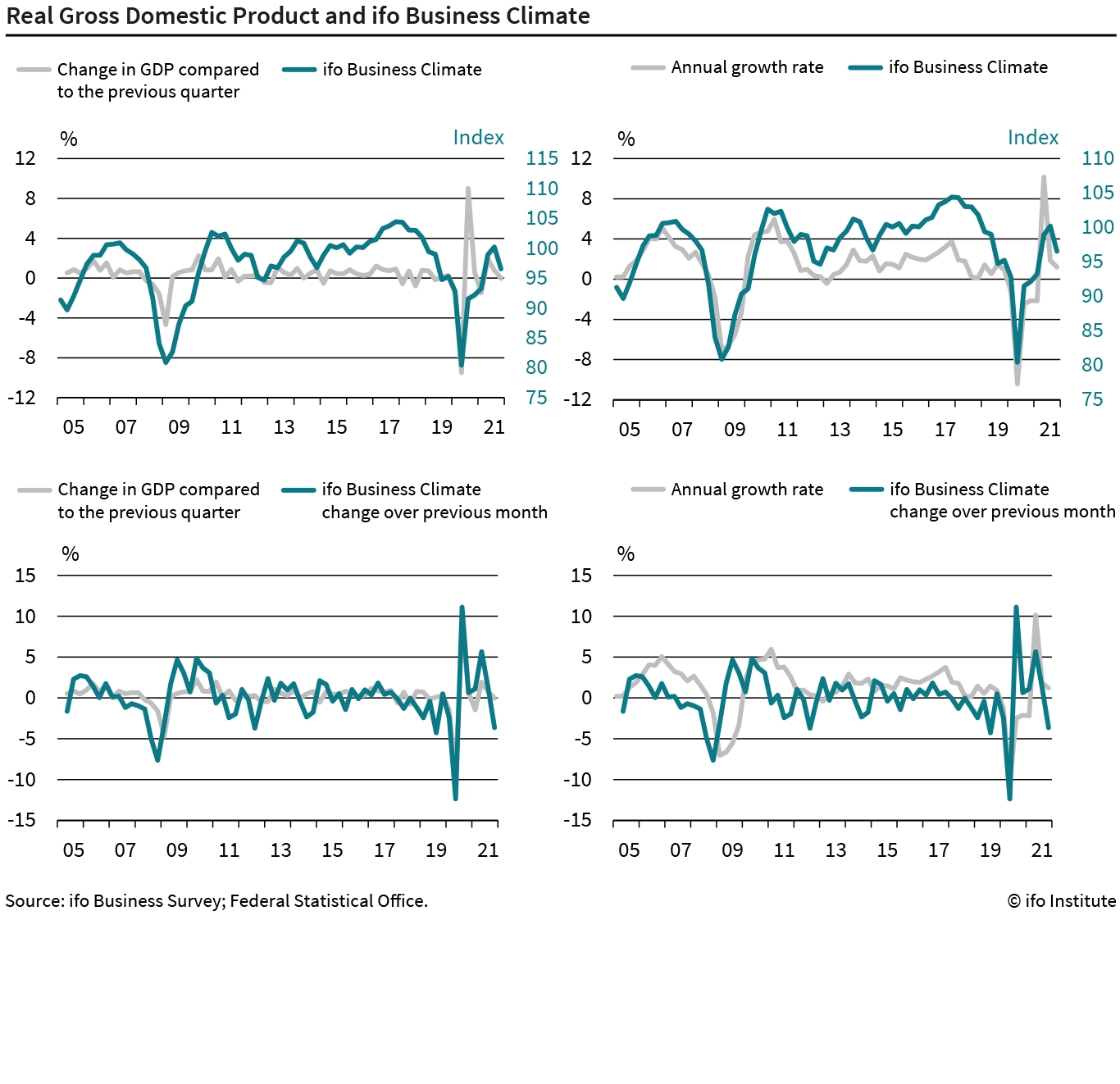

The ifo Business Climate Index, published monthly, has become an essential tool for decision-makers in business, politics, and finance. But how did the ifo Institute conceive of measuring the business climate, and why do these figures captivate such widespread attention even beyond the business community?

A Pioneering Endeavor by the ifo Institute

The idea of assessing the German economy through surveys of company managers was initiated in 1948 by the “Information and Research Center for Economic Observation” of the Bavarian State Statistical Office, which later evolved into the ifo Institute. Following the currency reform in 1948, which drastically altered the economic landscape, there was a pressing need for dynamic indicators to complement traditional statistics. Gathering this data directly from entrepreneurs was a groundbreaking approach to empirical economic research in Europe at the time. Post its establishment in 1949, the ifo Institute refined this survey method, focusing not on specific company data but on qualitative assessments of companies’ own developments – a practice that remains central to ifo surveys.

In the 1960s, the institute in its extensive questionnaires increasingly concentrated on business climate indicators, synthesizing assessments of current business conditions with expectations for the next six months. This unique feature of the ifo Business Climate Index today allows for early detection of economic turning points.

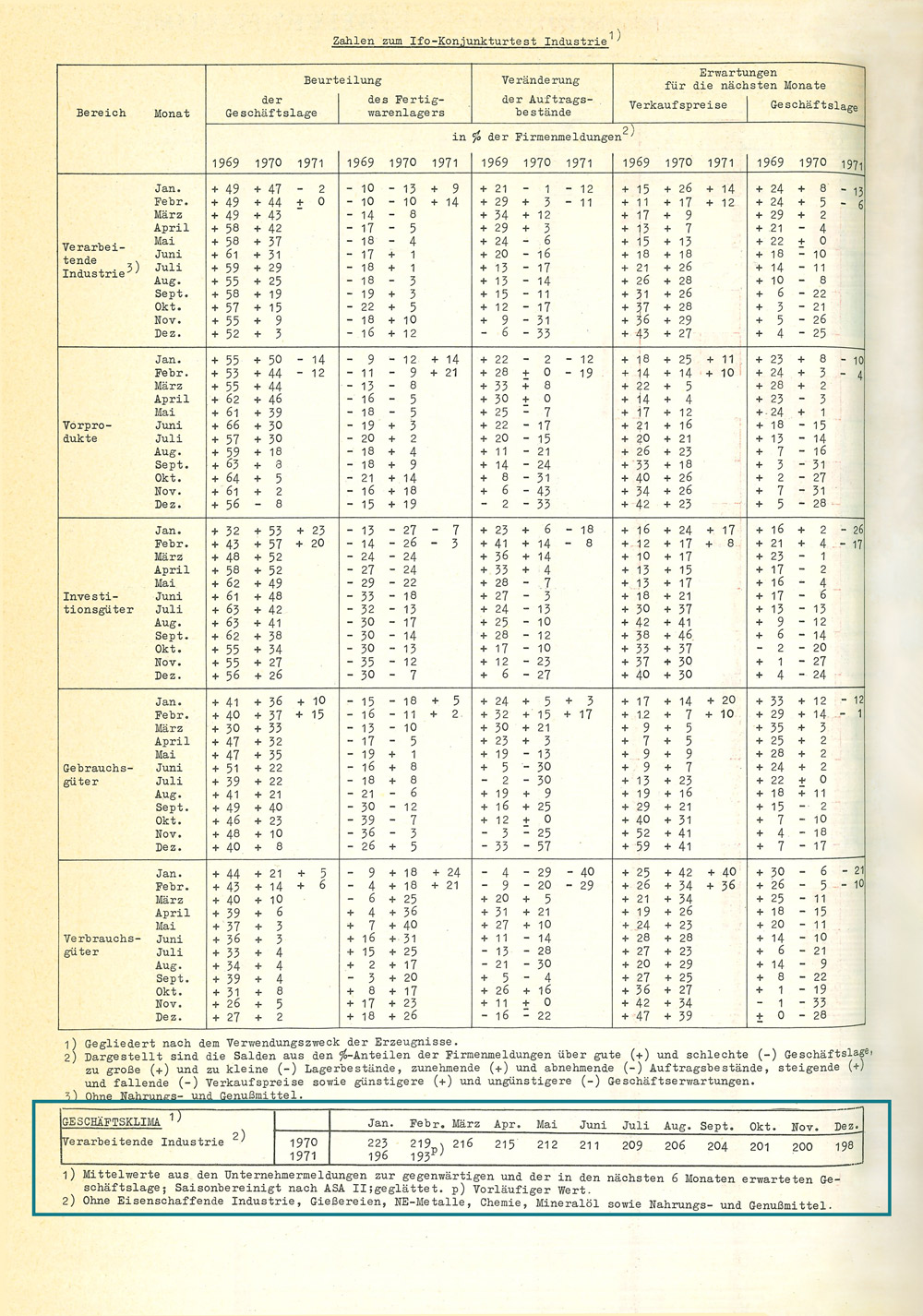

In March 1971, ifo discreetly introduced its “Business Climate Manufacturing” index in the ifo Schnelldienst. At that time, its potential significance as a leading economic indicator was not yet recognized.

Four Sectors, Business Situation, and Expectations

Today, the ifo Business Climate Index is derived from about 9,000 questionnaires from companies across manufacturing, construction, wholesale, retail, and service sectors. The index calculates the difference in responses categorized as “good” versus “bad” for the current business situation and “more favorable” versus “less favorable” for future expectations. Neutral responses such as “satisfactory” or “unchanged” are excluded from the calculations. The final index is the mean of these balances, reflecting both present conditions and future prospects.

A Sample Calculation

For example, if 40 percent of surveyed companies describe their current situation as satisfactory, 35 percent as good, and 25 percent as poor, only the responses categorized as good or poor are considered. The difference – 10 percent in this case – represents the current business situation score. Expectations for the next six months are calculated similarly, and the ifo Business Climate Index is calculated each month as the average of the current situation value and the expectations value. The index can range from -100 (if all respondents view their situation as poor and anticipate worsening conditions) to +100 (if all view their situation as good and expect improvement).

Strict Protocol for Publication

The ifo Business Climate Index is one of the most closely watched indicators for assessing the German economy, capable of triggering movements in the financial markets. Therefore, its calculation and publication follow a strict protocol:

• At 7:00 AM, the results of the calculations performed the night before publication are sent to the Head of Surveys.

• By 8:00 AM, the Head of Surveys analyzes these results, considering sector-specific data like automotive industry trends important for the overall interpretation, and drafts a press release.

• At 8:45 AM, key personnel, including the ifo President, the Heads of Economic Forecasts and Surveys, the Head of Surveys, the Head of Communication, the press speaker and a translator discuss and finalize the press release.

• By 10:00 AM, the press speaker reads the release in a video conference. It is then distributed in multiple languages to news agencies accredited with the European Central Bank.

• At 10:30 AM, the index is published on the ifo website.

A Trusted Economic Barometer

The ifo Business Climate Index garners significant attention due to its timely correlation with actual economic trends, making it a reliable basis for strategic decisions in businesses, politics, and finance. Unlike statistics that may lag, such as quarterly GDP reports by the Federal Statistics Office, the ifo index offers up-to-date insights.

Participating companies benefit not only from contributing information but also from accessing detailed analyses unavailable elsewhere, underpinning the success of the ifo Institute’s flagship service.

Note: For the sources used in this text, click on the imprint.